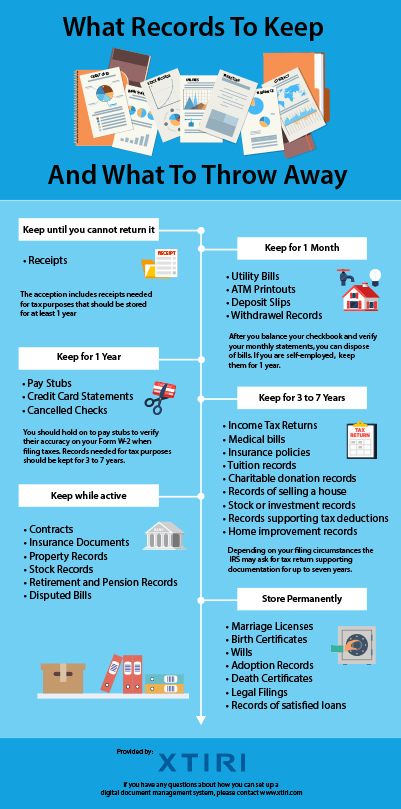

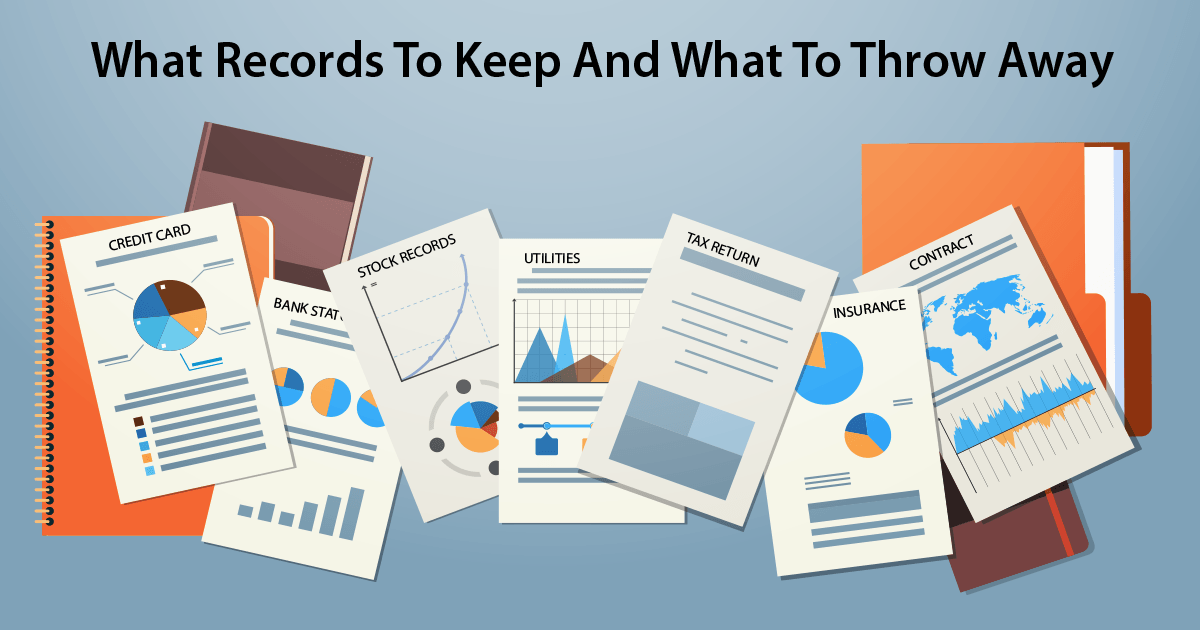

What Records To Keep And What To Throw Away

As we move through life, we accumulate a history of our transactions and financial records. As we collect this information, the filing cabinets and boxes begin to add up. It is difficult to know how long to keep documents, files, receipts, bills, contracts, and the records of our personal and business lives. When is it safe to throw them away? Is a digital copy sufficient or do we need to hang on to the original paper document?

Some things you need to hold on to for your whole lives and others for just a few months. You probably already know that important documents such as tax returns, bank statements and paycheck stubs need special attention, but for how long, and in what format? And how do we keep that personal data safe?

Here are 6 categories describing how long to keep your documents and files:

Keep until the warranty expires or you cannot return it

- Receipts

The acception includes receipts needed for tax purposes. If they are needed for tax purposes, you will need to keep them for 3 years.

Keep for 1 month

- Utility bills

- ATM printouts, deposit or withdrawal records

After you balance your checkbook and verify your monthly statements, you can dispose of cable and cell phone bills. If you are self-employed, you may need your bills for tax purposes, therefore requiring that you keep them for 1 year.

Keep for 1 year

- Pay stubs

- Credit card statements

- Cancelled checks

You should hold on to pay stubs to verify their accuracy on your Form W-2 when filing taxes. The acception includes records needed for tax purposes. If they are needed for tax purposes, you will need to keep them for 3 years.

Keep for 3 to 7 years

- Income Tax Returns

- Medical bills

- Insurance policies

- Tuition payment records

- Charitable donation receipts

- Records of selling a house

- Records of selling a stock

- Receipts and documents that support income or deductions on your Tax Returns

- Annual Investment Statements

- Home improvement records

Depending on your filing circumstances the IRS may ask for tax return supporting documentation for up to seven years after you file a return.

Keep while active

- Contracts

- Insurance documents

- Property records

- Stock records

- Records of retirement and pension plans

- Disputed bills

Store Permanently

- Marriage Licenses

- Birth Certificates

- Wills

- Adoption Papers

- Death Certificates

- Legal filings

- Records of satisfied loans like Mortgages

Think before you throw documents and files away. It is wise to keep documents and files as long as you can. You never know when you will want to dig up the old records to confirm or reflect on information. If you are simply trying to save space, scan the document and store your digital files in a secure cloud based storage solution. This is huge advantage of digital storage, it doesn’t require space and it is safe from disaster.

Protect your important documents and files. It doesn’t take a hurricane of fire to destroy your records. It can be a broken pipe, spilled cup of coffee, overactive dog, or even vandalism. You can also lose important records when someone accidentally throws away the wrong piece of paper or pushes delete too soon. But you can take steps today to protect your important documents, contracts, medical records, legal files, or precious photos from catastrophic loss. For more information visit our earlier blog post, 8 Ways To Protect Your Important Documents And Files.

Properly dispose of documents and files. Invest in a cross-cut shredder that will eliminate all traces of your personal information. Don’t put yourself at risk of identity theft by simply throwing away private documents and files. Once you create a digital copy, destroy the file. Don’t just throw it away.

If you have any questions about how you can set up a document management system or establish a backup plan, please contact XTIRI. XTIRI is more than document storage. XTIRI keeps your records safe and makes data accessible when and how you need it. Find out how to keep your important documents safe and secure at XTIRI.com.